Healthcare benefits on the road

I like to post things chronologically and lately I’ve been a few weeks behind on the blog posts (always watch our Instagram account for real-time travel updates). But I thought I’d jump ahead to talk about a big event that happened last week on the road – Hadley broke her arm! My sweet, adorable girl broke her humerus (the long bone in the upper arm). Let me tell you about it. . .

We were enjoying an amazing spot at Lone Rock Beach on Lake Powell. It was beautiful and the kids had so much room to run around and play that it made me so happy. To make things even better – we were traveling with one of our favorite families (@upintheairstream on Instagram) so not only did the kids have an epic place to play, but they had some of their best friends to play with. Things were going so well and I was so happy to see them run, smile, laugh, play and be outside. They were falling into bed exhausted and happy every night – what more could a mom ask for?

Our last night at Lone Rock Beach the kids were playing in the “fort” they created on the beach. It was a hole of sorts near the water. Liam jumped into the fort and Hadley followed closely behind – as she often does. She landed wonky – on her elbow, on harder, wet sand and was instantly in pain. I knew something wasn’t right because she’s such a tough cookie – she rarely cries when she gets hurt. . .but she was in pain and it quickly swelled up. We iced it right away and I found the nearest Urgent Care facility in Page, Arizona (about 20 minutes away). They closed at 6 p.m. and we got there at 5 p.m. – but they didn’t have an x-ray machine! So they sent us across the street to the Page Hospital Emergency Room.

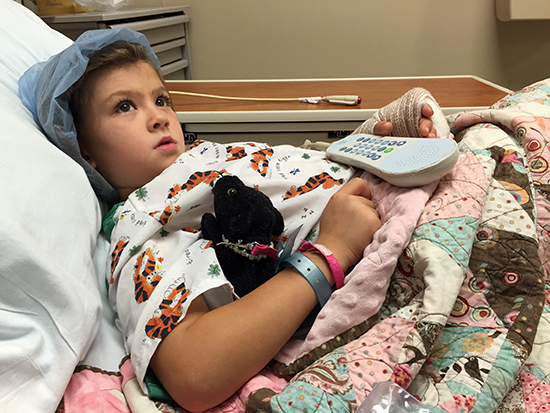

The silver lining of the ER was they had cable so Hadley got to watch the Disney channel. 🙂

The silver lining of the ER was they had cable so Hadley got to watch the Disney channel. 🙂

The hospital in Page was amazing – they got us right in, did x-rays and quickly confirmed she had broken her humerus near the growth plate in her elbow. We explained we were headed to St. George, Utah the next day (a MUCH bigger metro center) and they referred us to an orthopedic doctor there. It was a good thing that we were already planning to head to a metro area – because Page is such a small community they had to send our x-rays to PHOENIX to get them reviewed! The emergency room staff put Hadley in a temporary cast and sent us home with after-care instructions.

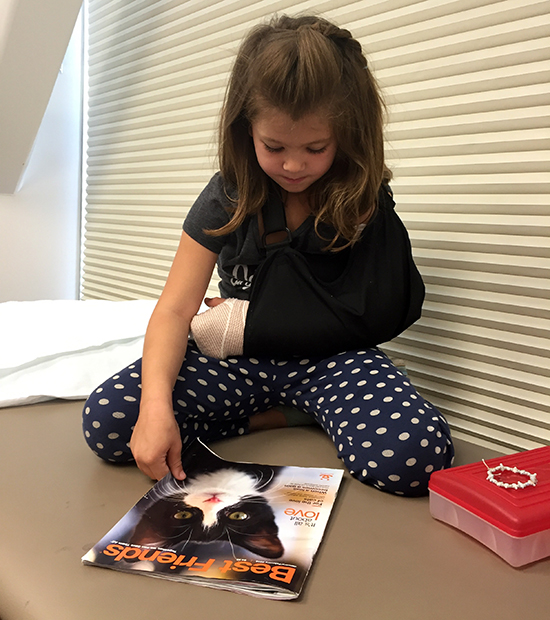

Hadley looking at a pet adoption magazine at the orthopedics office. Now she wants a dog. 🙂

Hadley looking at a pet adoption magazine at the orthopedics office. Now she wants a dog. 🙂

We got a call from the orthopedic doctor in St. George and he recommended surgery on Friday. Before this accident I had no idea a kid could need surgery for a broken arm! But because the break was so close to the growth plate, surgery was the best care option for her. I spent a half-day on the phone calling our insurance company and considering our options. . . Do we fly home to Washington for the surgery? Do we have the surgery here? Can we drive home in time to get surgery? What was the best choice for Hadley?

After MANY phone calls with our insurance company we confirmed that the doctors and hospital in St. George were “in network” – a major consideration when factoring the cost of a surgery. I learned more about insurance than I ever wanted to – getting procedure charge codes, checking preauthorization, calculating deductibles and making copious notes about my conversations with the insurance company. We had doctors ready and willing to do the surgery and the timing was ideal to just have the surgery done in St. George (instead of flying home). I was honestly terrified to get a big medical procedure done on the road – but I knew it was the very best thing for Hadley.

We had originally planned to leave St. George, Utah on Sunday morning to head to Zion National Park, but opted to change reservations (and sites) so that we would stay put from Thursday thru Sunday night – so we wouldn’t be moving locations the first few days after the surgery. We were willing to stay as long as we needed to make sure Hadley was near the doctors she needed and she was getting the rest she needed to heal. In fact, I was willing to call off the rest of our spring travels and drive straight “home” to Washington if I thought it was the best thing for Hadley. Whatever we needed to do.

Friday morning, very early, we went to the local hospital and Hadley was admitted into surgery. It was everything I could do not to cry! I think I was more worried about the anesthesia than the two pins they’d be putting in her elbow. But there were no tears – from me or Hadley (she was so brave!) and after just a couple hours she was out of surgery. The surgery went even better than expected – the doctor initially thought he’d have to create an incision to adjust the bones before inserting the pins – but he was able to align the joint without an incision – yay! Two pins were inserted securing the break and her arm was cast. The roughest part of it all was the short period after surgery while the anesthesia was wearing off – Hadley was emotional, confused and in pain. But popsicles and movies on the iPad were enough of a distraction to get her through recovery and within a couple hours after the surgery she was doing so well.

We were blessed with this beautiful rainbow the afternoon after the surgery.

We were blessed with this beautiful rainbow the afternoon after the surgery.

We got home from surgery and spoiled her with Ben & Jerry’s ice cream, popsicles, movies and snuggles. I thought she’d be lethargic and sleepy after the surgery – but not at all. In fact, I was the one that collapsed on the bed and slept for three hours! Within 12 hours the biggest struggle we had was forcing her to stay in bed, elevate and ice. She wanted to be running, playing and outside – that was the hardest post-op struggle.

On an easy walk with mom Sunday night

On an easy walk with mom Sunday night

The whole weekend was spent watching movies and taking it easy. On Sunday night, a dear friend of mine invited us over to her house (in St. George) for a barbecue. Hadley wasn’t even needing pain meds anymore – and was itching for playtime – so this was a welcomed outing. She played with the other kids and we had a wonderful time. That night we went for a walk at sunset. . .after being so cooped up, she wanted to be outside so bad!

The following Monday we went back to the orthopedics office and they put another layer of casting over her arm. Her initial cast was split to allow for any post-op swelling and wrapped in an ace bandage. The doc said we could leave the cast split – or we could get a complete cast – and I said, complete cast please! Whatever will keep her arm the safest and most protected until we get the pins out in six weeks (probably in Washington). She picked a blue cast and is adapting so well to having one arm continuously bent (she’s a righty, thankfully),

So there you have it.

We had an “emergency” on the road and we seemed to have survived. It was honestly one of my biggest fears – and we seemed to work through it just fine.

Keeping up with brother at Zion.

Keeping up with brother at Zion.

We are now at Zion National Park just a day later than originally planned and Hadley has been outside nonstop. She is in ZERO pain without a need for Tylenol or pain meds. Yesterday the park ranger here asked if he could sign her cast. . . and she let him. 🙂 As I mentioned the biggest challenge is trying to get her to slow down and be more careful.

Now we just heal up and wait for the bills to come in to see how much an emergency like this on the road will cost. I’ve had a lot of people ask about our benefits on the road, so I thought I’d explain a bit about what we have.

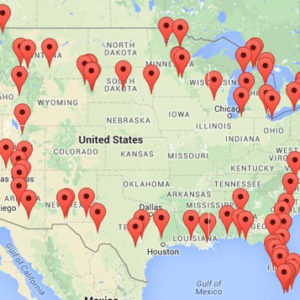

When my husband’s teacher health benefits ran out last September, we had to get private health insurance – something very NEW for us. We purposely chose Blue Cross – a nationwide plan – so that we would hopefully have the most and best options on the road. But it’s expensive. We pay $1,100 out of pocket every month for our HEALTHY, young family of four to have health insurance on the road – ugggh, it’s by far our biggest expense on the road. I even found myself questioning this benefit plan the last couple months – should we switch to a higher deductible plan and pay less every month? Because the ONLY time we have needed a doctor on the road (in a full 10 months) was an urgent care visit in the Florida Keys – when I had bronchitis and Hadley had swimmer’s ear. All we needed was antibiotics.

Even with a monthly payment of $1,100 every month, Hadley’s deductible is $3,000 and after that, insurance pays 80% and we pay 20%. She does have a personal limit of $6,800 out of pocket for the year – so if everything stays in network (like I confirmed and double-checked) than hopefully that is the most we will have to pay out of pocket. I hope. Our family out-of-pocket limit is $13,500 so that’s the most we would technically have to pay for health care (in addition to the $1,100/month) for the year (if someone else in the family has a major incident). That’s a whopping $26,700 a year for a family making a very average income. It’s crazy if you ask me, but we don’t need to get into a debate about healthcare costs. It is, what it is, and we do what we need to.

Of course we would pay WHATEVER we needed to get her the care she needed but this is an expensive accident. The crazy thing I learned by talking with my insurance company is if you get healthcare outside of your network they can charge you higher prices and it often doesn’t go toward your deductible or out-of-pocket limit. How crazy is that? I was terrified this would happen – so that’s why I confirmed that the doctor, his office, the hospital, the anesthesiologist and all the people involved in the care were part of our network. I called my insurance company countless times to have them make notes that I called and that I had confirmed people were in our network. If you’re traveling full-time on the road make sure you know how national your health care network is – because you can’t always get home for “in network” care.

We will be holding our breath the next few months until we see how much things cost. If we end up closer to the $6,800 out-of-pocket limit than we might cut our traveling short. As much as we would hate to do this, that’s 6 months worth of health care premiums or a few months of living expenses on the road – however you look at it. Although we have the money in savings – for emergencies like this – it does play a role in how much money we’ll have for a house or for transitioning back when we are done traveling. So we have to take that into consideration. . . so we will carefully consider that over the next few months as things shake out.

I do feel a bit like I’m oversharing here. I’m putting it all out there. But I want to be very honest – because healthcare is a big part of the decision to travel full-time – especially for families. I don’t know what the BEST plan for your family would be if you were or are traveling fulltime – I don’t even know if this is the BEST possible plan for our family. But I cringe to think what we’d be paying if we had went with an insurance plan that would have had a cheap monthly payment but had a small network of providers – because they can really charge whatever they want if they are outside your approved network! And as we have learned, sometimes we don’t get to choose when and where we get healthcare.

I’m so grateful that Hadley is okay and healing well. I’m grateful that we had access to amazing doctors who provided top-notch care (really, I was regularly impressed by the healthcare professionals in St. George). I’m grateful for insurance because even though it’s expensive it’s still cheaper than if we didn’t. I’m grateful that we purposely have a safety net that catches us and allows us to cover these costs. And I’m grateful for you . . . many of you prayed for Hadley and shared encouraging notes over on the Take That Exit Facebook page – we felt so much love and support last week – and I’m so grateful for that.

Do you have any questions about health care on the road? Do you have suggestions for health care options? I’ll try to answer any questions you might have – although I’m not an expert, I have learned a lot about it in the past few days. 🙂

Gel Ice Cold Compress Pack – 2-Pack – Reusable

We thankfully had a variety of these reusable, soft ice packs in the freezer ready to go when Hadley hurt her arm.

First Aid Kit Hard Red Case 326 Pieces Exceeds OSHA and ANSI Guidelines

When you shop Amazon here or through any of our links – we earn a commission on any sales – at no charge to you – so it supports our family on the road and we are so grateful for that!

Do you have an HSA? That is a Health Savings Account. It lowers your taxable income and you can use it like an FSA – you pay for your medical stuff out of that vs. your own checking account. You can either fund it via workplace payroll or fund it yourself after taxes, and then get that tax back. The IRS limits the amount per family you can put into a HSA, but it’s a really great product!

We don’t currently have an HSA although I have heard amazing things about them. It’s likely, after this experience, that we will switch to an HSA when we have open enrollment this fall.

Thank you for sharing. I am glad that Hadley is recovering quickly. At least you folks are in a beautiful area that I like to call “God’s country.” If you guys need to settle down for a bit in suburbia, that’s ok too because you can always return to do the Grand Circle later. best of wishes to your family. BTW, I think that your logic and reasoning are unbelievably sound. Keep it up, mama.

Hi Cheryl – Yes, I agree, Zion is incredible. The stress just melted away the minute we unhitched here. We are looking forward to being together, outside, as much as possible in the next few days. It renews and re-energizes us.

And thanks also for your encouragement – I try to be logical – it’s the Virgo in me. But I also question my decisions a lot. I want to do the absolute best for my kids and our family but and I’m learning as I go. 🙂

Thanks again for the comment!

Have you ever considered a sharing plan?? We do not travel but there is no network drs involved. It is ideal for a healthy family who only needs sick and emergency visits. We use Christian Healthcare Ministries (http://www.chministries.org/) They are approved for Obamacare as well.

We did look into that plan – we know a lot of traveling families who use that plan and are happy with it. Honestly we didn’t choose this plan because we weren’t comfortable with some of the requirements (like attending church regularly) to qualify for health care coverage. I love the co-op model of healthcare – I believe it’s smart and beneficial for those involved but we just couldn’t get comfortable with blending our religious practices with our healthcare needs. I know it’s a great fit for many families – and based on what we have learned from other families, we’d probably pay closer to $500/month for our monthly premium – much less than the Blue Cross plan. Definitely an option for families on the road!

Ugh. My husband fell on wet pavement in flip flops and broke his elbow. He had to get 2 pins and it was awful when the anesthesia wore off. They had to give him a lot because he is 6’4 and meds wear off fast for him. I was worried most about the anesthesia too! Anyway we were lucky to have good health insurance at the time. We actually moved from a place and condo we loved (in FL) back to MA for good health insurance benefits. We want to full time RV (Airstream) starting next year, but we have to look closely at the ACA. I think more young people would start their own businesses, travel more, retire early, full time RV, etc. if not for the worry of health insurance!

Patricia – I’m so sorry to hear about your husband breaking his elbow! So glad he got the care and surgery that he needed to repair it properly. I think you are VERY right about health insurance being a barrier to traveling more, retiring early, full-time RVing. If we could be investing our $1,100 a month into a retirement account it would seem like such a better use of the funds! Best of luck to you as your travel fulltime in your airstream next year – keep us posted, we’d love to follow your journey!

Thank you! Check out our blog if you get a chance.

Sorry to hear about your “Healthcare Emergency on the Road” but so glad to hear the surgery was a success! We have recently faced the worry about paying for hospital bills and the joy of insurance finally coming through. The waiting is the hardest. From what you have shared, I have faith that you have done your homework and God will take care of this too. Continued Travel Mercies!

Hi Robin – Thank you so much for your encouraging words. I think waiting is one of the hardest parts! We will see.

I’m glad your daughter will be okay. An injury like this is stressful even when you’re not traveling.

I guess this is a logistics-type question: how do you receive mail while you’re on the road? I would guess there are some things that can’t be sent to you electronically.

Hi Julie – Great question! We did automate a lot of things (like bills) but we have a UPS box address which we have forwarded to another UPS store whenever we are in a location long enough. If we have a friend or family member in an area – we will have our mail forwarded from the UPS store to them. It costs about $30 every 5 weeks – we certainly don’t get mail everyday anymore, that’s for sure, it’s about once a month.

1100 doesn’t seem abnormal. my husband is in a professional industry with company subsidized insurance and we pay 986$ a month for our family plus deductibles copays prescriptions. it’s gross.

I don’t think it’s abnormal, I think it’s pretty standard for a family of 4. When my husband had benefits through work (as a teacher) we paid $700 a month out of pocket (with the school paying a matching portion).

Heal fast Hadley! Mom and dad, take it easy for a few days. Honestly it was probably harder on you both than Hadley. What a trooper Hadley is. Liam take care of your parents and sister.

Thanks, Aunt Lorna! She is so resilient – I think you’re right about it being harder on us than her. Liam is doing a great job taking care and watching over his sister.

I would think you’d be able to make monthly payments on hospital bills, as little as $50 a month I’ve heard. Also, you can apply for some of it to be forgiven, especially if you have a moderate income. People I know have had great luck doing that, paying only a small portion of their total medical bills. Good luck!

Hi Jamie – I think we probably could! We will see how the bills shake out and see what we need to do.

My then-6-yo son broke both the bones in his lower arm 3 days before we were going to leave on a 2-week trip across the country. After surgery he had a finger to underarm cast that he had to wear for at least 6 weeks 🙁 We were able to see the ortho in our area for the 3-day checkup after surgery, then got follow-up appointments for our new location.

His main disappointment was that he couldn’t go in the swimming pools as we traveled! He had really been looking forward to that.

However, he discovered video games on that trip (Game Boy and Nintendo), and those became a lifelong passion of his, so it wasn’t all a loss for him.

I’m glad to hear that your daughter’s not slowing down.

If Hadley had a visit to the doctor/urgent care in Florida and it was in network remember that that visit goes toward your deductible. That way at least that visit will have started the deductible so at least if you end up paying up to her maximum (in a way) that visit will be paid.

Does that make sense?